I’m starting a series called Marketing Monday, with tips and tricks on more effective marketing, from market research to social media, from public relations to branding.

Eventually I plan to move the series to a new website at colleennewvine.com, but in the meantime, I think improving sales and customer communications is close enough to improving your personal and professional life that I’m kicking it off here.

I welcome your feedback. What would you like to know about improving your marketing?

Does owning pots and pans make you a Top Chef contender? Does having a piano in your house get you a recording contract? If you buy a paint brush, will you become Picasso or Van Gogh?

Unfortunately some people confuse the availability of a tool with the skills to use the tool well.

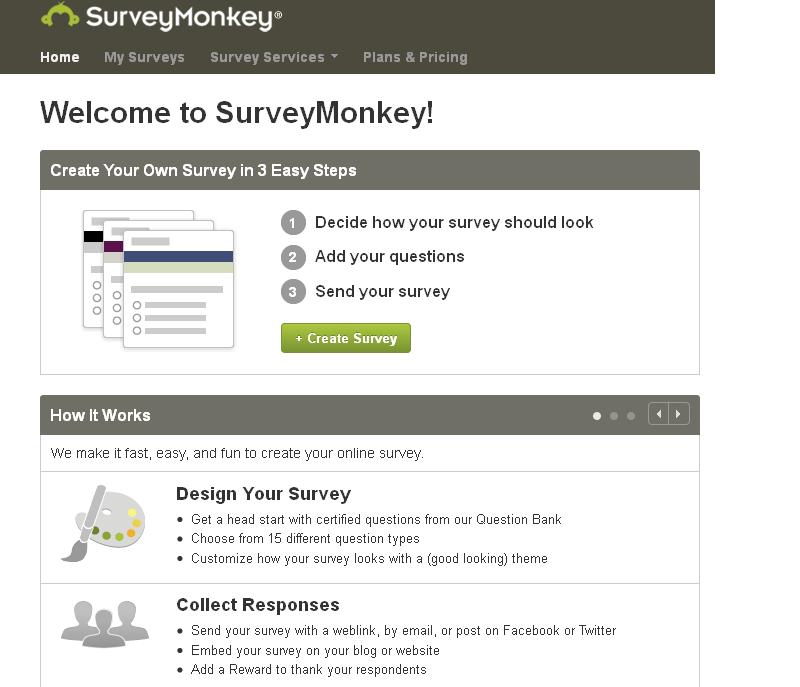

Online survey tools like SurveyMonkey, SurveyGizmo and many others make it quick and easy to solicit feedback then analyze the results.

But if you don’t put thought into what you’re asking and how you’re asking it, as well as what the answers mean, you might have the best of intentions for listening to your customers but accidentally get led astray.

Here are five tips for improving your do-it-yourself market research via online surveys:

1. Carefully consider who you will ask and how.

Let’s say you want to ask your customers how you can improve your service. You’ll put together a survey and email it to your customers. Easy.

But do you value all your customers equally? Are some of them far more profitable than others? Are some huge time wasters who complain about everything? Maybe you only want to survey a segment of your customers.

Do you have valid email addresses for all your customers? Are some of your customers tech phobic or do you do business with them only by phone or in person? Maybe you’ll need to mail a postcard with the survey link or call some customers to ask for their feedback verbally.

If some of your customers are big organizations, which of your numerous contacts there do you survey?

What about reaching potential customers — those people you’d love to sell to but haven’t yet?

Thinking through whose opinion you want and how you’ll reach those people can shape the kinds of questions you ask.

2. Choose your words wisely.

Have you ever asked a sullen teenage girl across the dinner table, “How was your day?” Did you get any useful information? Did you maybe have to ask a more specific question? Or get persistent?

How you ask a question influences whether you get a useful answer.

Constant Contact offers best practices in writing questions including asking just one thing per question, limiting the number of questions so the survey takes only five or 10 minutes and asking mostly multiple choice questions.

Usability.com suggests, among other things, looking for overlapping answer choices (do you offer “three or four times a month” and “weekly” as frequency choices, for example?) and making sure you proofread your survey.

I think ratings are easier and faster to answer than rankings, and ratings choices (1-5 or 1-7, for example) should have an odd number so you can choose dead center if you’re neither positive or negative about something. I always include a “don’t know/ unsure” choice, and “does not apply” is helpful in giving people a chance to opt out of giving you an unhelpful answer.

3. Compare the demographics of your participants to the demographics of your customer base.

Hopefully you know who your customers are, either because you have a customer database or because you interact with them regularly.

One good reason to include demographic questions in your survey is to make sure the participants look like your overall customer base. That way, if most respondents say they have 10 employees or fewer but you know more of your customers are bigger, for example, you know your survey results might not be representative.

4. Look for trends in your results, but don’t assume the majority speaks for everyone.

When I use Yelp as a consumer, I assume that the people most likely to take the time to write a review are those who love a place or who hate a place. If a Chinese restaurant is serviceable but not great, would you feel compelled to tell the world, meh?

I assume the same when analyzing a survey. People who love you will give you feedback as a favor, people who hate you are only too happy to have the chance to sound off. I figure we’re all so busy that those who find you adequate but uninspiring might have better things to do than give lukewarm feedback.

If I see outliers in survey results, I take the time to learn who they are. What are their demographics, are they extremely negative on every question or just some? If it looks like a valuable customer hates your customer service, for example, that’s just as important as knowing 80 percent of respondents are happy.

5. Remember that talk is cheap.

One of my favorite takeaways from my favorite market research professors is that asking people what they will do in the future is not nearly as trustworthy as asking what they’ve done in the past.

Why?

If you ask me if I would pay $40,000 for a new car, maybe I answer it as a theoretical evaluation of whether I think that new car is worth $40,000. Or maybe I would it if were just me, but my husband is completely opposed to buying new cars and I wouldn’t bother fighting that fight. Or maybe I’m overestimating what I could get to trade in my current car, or underestimating loan interest rates … or just want you to think I’m financially better off than I really am.

Instead, maybe you should ask when I last bought a car and how much I spent on it. My past behavior is known, not hypothetical.

If you ask questions about what your customers might like in the future, try to be as specific as possible. What would you offer and for how much? Instead of “would you like an ice cream cone?” how about “would you like a double dip mint chocolate chip waffle cone for $5 on an 85 degree day in July?”

A final tip: an online survey is one way to get insight into your customers, but not the only way. If you talk to your customers every day and something in the survey results doesn’t feel right, dig deeper. Ask a few of your best customers to discuss the survey results. Ask colleagues. It’s possible you’re wrong in your thinking about your customers, but it’s also possible there’s more to the story than your survey results.

Colleen Newvine Tebeau earned her MBA at University of Michigan with emphases in marketing and corporate strategy. While at Michigan, she did a market research independent study looking at the customer satisfaction of newspaper readers. She was director of market research for the Associated Press and now offers market research as one of her marketing consulting services.

Marketing Monday: 5 tips for better do-it-yourself market research